E-invoicing and e-invoice

Content menu

What is e-invoicing?

Electronic invoicing, or simply e-invoicing, is the business-to-business exchange of electronic invoice data between a supplier and a buyer.

Structured data format

An e-invoice is an invoice that is issued, transmitted and received in a structured data format. The structured format enables automatic and electronic processing.

Data from the supplier is embedded in the structured e-invoice. This data is in a machine-readable format and can be automatically imported into the buyer's financial system, which can read each unique invoice field and begin the invoice processing cycle without requiring manual entry.

What is an e-invoice?

An e-invoice consists exclusively of structured data and can be automatically imported into various business systems.

An e-invoice does not include a visual representation of invoice data, but can however be temporarily reproduced during data processing or transformed into visual formats. The visual presentation is not the primary purpose of an e-invoice, the purpose is automation of the invoicing process, and only in cases of irregularities is it necessary to see the individual invoice.

For reading purposes, it is possible to create a visualized readable version of the invoice which can be included in the structured message, but this version is not considered part of the invoice itself.

|

E-invoicing

Simply put, electronic invoicing, or simply e-invoicing, is a digitized and automated method of directly sending, receiving and processing invoices between supplier and customer.

|

An e-invoice requires two key features:

- An e-invoice must be created correctly and with the right structure.

- An e-invoice must be able to be transferred from the seller's to the buyer's system.

What isn't an e-invoice?

Please be aware that just because digital files such as JPG images, PDFs and other non-physical types of invoices are also digital and make it possible to manage and store the invoices more efficiently than is the case for paper invoices, this means not that these types of invoices fall under the e-invoicing category.

These file formats still require that the individual invoice is handled manually and that their content is manually read and entered into the ERP system.

E-invoices are not:

- Unstructured invoice data, for example in PDF or Word format.

- Digital images of invoices, for example JPG or PNG images.

- Unstructured HTML invoices on a website or embedded in an email.

- Paper invoices that have been scanned and digitized using OCR (Optical character recognition).

- Paper invoices sent as images via fax.

Advantages of electronic invoicing

E-invoicing makes it much easier and faster to handle your invoices and manage the way they are created, sent and received.

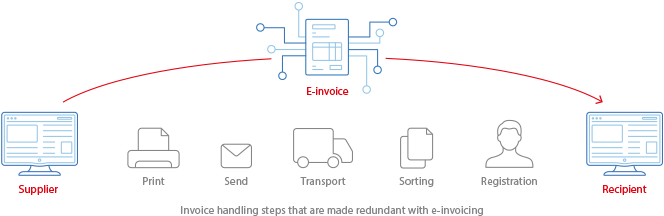

With electronic invoicing, you avoid a number of manual processes

Optimize the invoice processes

By streamlining and automating the invoice processes through e-invoicing, trust in the company is increased and the risk of lost or incorrectly delivered invoices is reduced.

With e-invoicing, you can easily and efficiently send digital invoices to your customers, both public authorities and private companies.

By using e-invoicing, you gain many advantages, including:

- Automatic posting of your invoices

- Comply with applicable legal requirements for electronic invoicing to the public sector

- Gain benefits from using e-invoicing to invoice private businesses

- Easy sending of electronic reminders

- Avoid paper waste

E-invoicing for the public sector

Since 2011, all public authorities in Denmark, i.e. the state, municipalities and regions, have been obliged to receive bills electronically. This means that it is a requirement for companies that have customers in the public sector in Denmark, for example state agencies, schools or regional hospitals, that invoices must always be sent as e-invoices. If they do not, the invoices are rejected.

|

First in the world

With a desire to streamline and save resources in the public sector, Denmark introduced electronic invoicing in the public sector in 2005 as the first country in the world.

|

How do I send an invoice to the public sector?

In order for you to send an invoice to a specific public institution in Denmark, you must use an EAN number from your specific public customer. If you want to send an e-invoice to a private company, the company in question must choose to accept it and you must use the company's CVR number.

EU and USA

In the rest of the EU, it has been a requirement since 2017 to use e-invoicing if you are a supplier to the public sector. Although there is a strong trend toward electronic invoicing in the United States, e-invoicing is not yet mandatory at either the federal or state level.

What does e-invoicing cost?

There are a large number of solutions for e-invoicing online. Some of them are free and some require payment. The payment solutions are typically licensed either via subscription (SaaS), where, for example, you pay a fixed amount per month, or per invoice, where you pay a unit price for each invoice that is processed.

Eksempler på licensering af online e-faktureringsløsninger på markedet kan være:

- Free

Is typically limited to a fixed number of invoices per month. - Standard

Typically gives access to send a higher number of invoices per month. - Premium

For large-scale invoice processing. Typically provides access to a very high or unlimited number of invoices per month.

E-invoicing in Business Central

With Business Central 2023 release wave 2 (Business Central 23), Microsoft added a ground-breaking new function ‒ E-Documents.

Electronic documents

Electronic documents, or simply e-documents, are at the heart of the business transactions of the modern enterprise. E-documents include important documents, such as invoices and receipts in both directions, i.e. both delivery and reception.

E-Documents in Business Central

In order to improve companies' e-document management and business processes, Microsoft developed the ground-breaking E-Document app, which makes it simple and efficient for Business Central users to manage e-documents, including e-invoices, in Dynamics 365 Business Central.

The E-Documents function was not just an update or new feature in Business Central, E-Documents is a completely new and fundamental framework that ensures flexibility and an efficient administration of electronic invoicing.

|

Please note

In order to use these functions, you must install the E-Document app in your Business Central environment.

|

Flexible e-document management

The smart thing about the E-Document app for Business Central is that it is flexible and can be used widely in countries and regions where companies have very different requirements for specialized e-document management, enabling them to comply with unique local regulations and regulations.

The E-Document app provides a solid foundation that can be easily extended and customized to meet local rules and regulations or specific industry requirements.

Summary

Efficient invoice processing

E-invoicing makes it much easier and more efficient to handle and send invoices. In addition, the risk of errors in invoice processing is reduced.

Requirements for e-invoicing from the public sector

If you do business with public authorities in the EU, US, and UK, it is a requirement that you use e-invoicing, but you can freely choose whether you want to use e-invoicing for the private companies you do business with.

E-invoicing solutions

It is easy to use e-invoicing, and there is a wide range of solutions on the web that you can choose from. Some of these solutions are free, but are typically limited in the number of invoices you can process, while other solutions are licensed by subscription or with a unit price per invoice. invoice.

It is up to the individual providers to ensure that their e-invoicing solutions comply with the technical requirements.